new capital gains tax plan

Contact a Fidelity Advisor. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of.

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

This week President Biden introduced a new tax proposal as part of the White House fiscal year 2023 budget to raise taxes on households with net wealth over 100 million.

. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. 2021 federal capital gains tax rates. 2 days agoCritics rally against Bidens capital gains tax proposal.

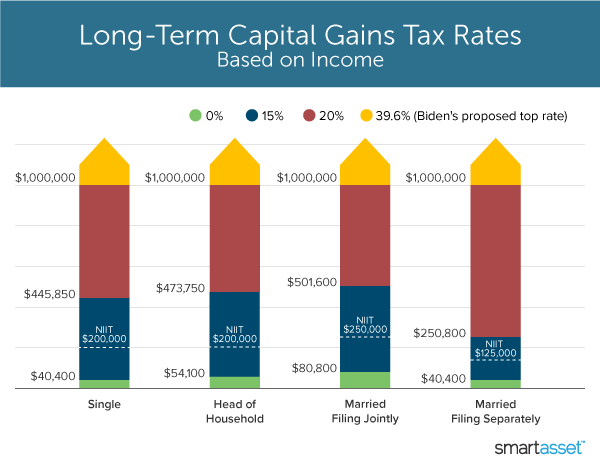

As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. Besides increasing the corporate income tax rate to 28 and long-term capital gains and qualified dividend rates for taxpayers with. Bidens plan called for a 396 rate on the top 03 of households.

For example a single. The new capital gains tax rate varies based on your income level property type and filing status. Currently taxes are collected on capital gains only when an asset is sold not when an asset increases in value.

51 rows The combined state and federal capital gains tax rate in New Hampshire would rise from the current 288 percent to 484 percent under President Bidens American Families Plan according to a new study from the Tax Foundation. House Democrats are calling for a 25 top federal tax rate on capital gains. The tables below show marginal tax rates.

This means that different portions of your taxable income may be taxed at different rates. There are exclusions on the capital gains tax for people who sold their homes in the past year. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

The proposal would require wealthy households to remit taxes on unrealized capital gains from assets such as stocks bonds or privately held companies. This matches the payment of taxes with the cash that is generated to pay those taxes. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket.

The White House estimates that the new tax would raise about 360. Bidens proposal would take the. That increase which would include federal state and local taxes on financial gains from the sale of assets in New.

The proposal focuses on taxing unrealized capital gains that are built up over years but are taxed only when sold for a profit. The capital gains tax on most net gains is no more than 15 percent for most people. Short-term capital gains on listed equities held for under a year is taxed at 15.

The current rates are 0 15 or 20 depending on income. Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. You can exclude up to 250000 of capital gains if you are single.

Govt plans reform in capital gains tax. The capital gains tax has long been part of the political tug-of-war and with the release of President Bidens FY2022 budget proposal the change to the capital gains tax regime looks to be one of the more interesting proposals. A quick refresher on our current capital gains tax system.

Capital Gains Tax Rate Set at 25 in House Democrats Plan. 15 Mar 2022 0558 AM IST Gireesh Chandra. The plan would establish a 20 minimum tax rate on households worth 100 million or more and would expand the definition of taxable income to include the accruing value of unsold investments like stocks or bonds otherwise known as unrealized capital gains.

What the Biden administration outlined on Monday would raise 361 billion over 10 years and apply to the top 001 of households. If you sold your house in 2021. 3 min read.

Rate would rise from 20 under House panels proposal. The proposal lists another 14 trillion in revenue raised over. The Center Square President Joe Bidens newly released 2023 budget included a tax.

Biden had wanted to boost rate to 396 for highest earners. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Currently gains on investments are only taxed when theyre sold for cash.

However there is good news for many homeowners.

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate Courses

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Capital Gains Definition 2021 Tax Rates And Examples

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investing

Calculating Capital Gains Tax On Stock Splits Capital Gains Tax Capital Gain Investing Money

Capital Gains Taxes 5 Basic Things To Know Capital Gain Capital Gains Tax Basic

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Long Term Short Term Capital Gains Tax Rate For 2013 2016 Http Capitalgainstaxrate2013 Tumblr Com Post 719 Capital Gains Tax Wealth Planning Capital Gain

Accelerating 2021 Business Sales To Navigate Biden S Proposed Capital Gains Tax Increase Financialadvicers In 2021 Capital Gains Tax Capital Gain Business Sales

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube Family Finance Capital Gains Tax Capital Gain

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Taxation Capital Gains Tax Indirect Tax Types Of Taxes